Article: Making holiday magic with school spirit

Using back-to-class shopping behaviors to inform your holiday game plan

Back-to-school routines are in full swing for most families, from navigating the drop-off line to juggling after-school practices. The supplies purchased this past summer are finally being put to good use in the classroom. While students may have forgotten the excitement of their back-to-school haul, the recent investment might not be such a distant memory for parents and educators, alike who shouldered the expense.

During major shopping moments like back-to-class and holiday, suppliers can use past behaviors and trends as reliable predictors. That’s why we asked back-to-class shoppers at Walmart how they prepared for the 2024-2025 school year and how their shopping experience could shape their holiday plans. From school bells to sleigh bells, suppliers can take notes on these back-to-class shopping behaviors to help inform their strategies for the upcoming holiday season.

Budget lessons for yuletide spending

From one shopping whirlwind to the next, the back-to-school (BTS) and holiday seasons can feel like two big back-to-back investments for families. This year, half of surveyed Walmart customers said they stayed on budget for their BTS and Back-to-College (BTC) shopping, while 33% admitted to spending a bit more than planned.

With holiday shopping on the horizon, sticking to a budget remains important to customers. 48% of surveyed Walmart customers said they plan to set specific budgets for each person on their gift list this year. Without a trusty school supply list to guide shopping, many plan to get creative with their spending, from affordable stocking stuffers to gifts that keep on giving.

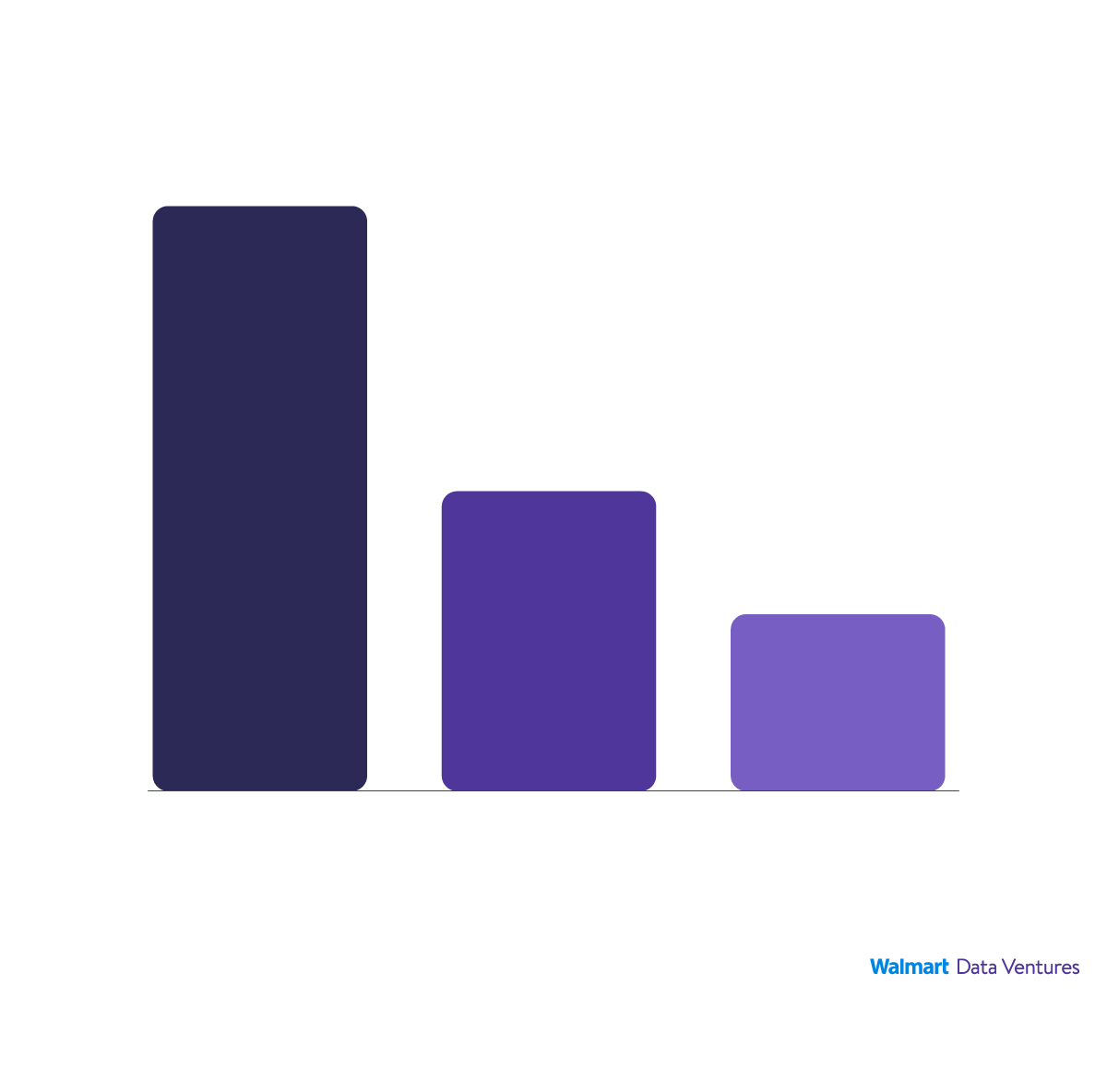

What type of holiday gifts are Walmart

customers priotizing this year

43%

22%

13%

Cheaper gift

options

Experiences

over gifts

More expensive,

longer-lasting

gifts this year

Source: Walmart First-Party Data, September 2024, "Holiday Survey"

Walmart Customer Spark Community, provided by Scintilla

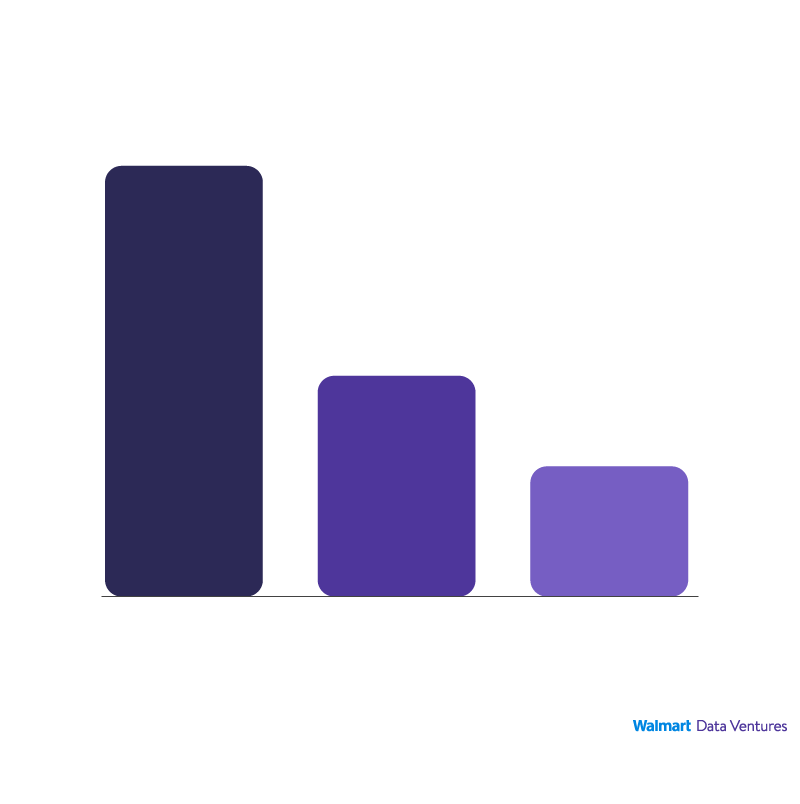

What type of holiday gifts are Walmart

customers priotizing this year

43%

22%

13%

Cheaper gift

options

Experiences

over gifts

More expensive,

longer-lasting

gifts this year

Source: Walmart First-Party Data, September 2024, "Holiday Survey"

Walmart Customer Spark Community, provided by Scintilla

So, how much are Walmart customers planning to spend on holiday shopping? While 86% say price will play a big role in their buying decisions, most plan to keep their holiday budgets within a set range. Some of the most popular budget ranges for holiday-related purchases are $100-$299 (14%), $300-$599 (31%), $600-$999 (22%) and $1,000-$1,999 (19%).

Scintilla Pro Tip: Leverage Customer Perception’s UPC hypertargeting to connect with verified shoppers in your categories to gather insights into their preferences and budgets. Use qualitative video surveys to gain real-time visual and auditory feedback, helping you capture customer emotions and decision-making processes. This deeper understanding can help you adjust product offerings and marketing strategies to align with their holiday gift priorities.

Early birds and holiday hustlers

When it came time to stock up for the school year, Walmart customers didn’t wait for the bell to ring—they got a head start! In fact, 30% of surveyed Walmart customers said they started their BTS shopping four weeks or more in advance. We also learned that these disciplined shoppers focused strictly on their school shopping lists, with more than half (57%) saying they did not purchase or browse for holiday gifts or items during BTS shopping.

This same proactive shopping spirit is expected to carry over to the holidays among Walmart customers. Of those surveyed, 57% said they plan to start shopping as early as possible. That means suppliers can connect with these early holiday shoppers right now.

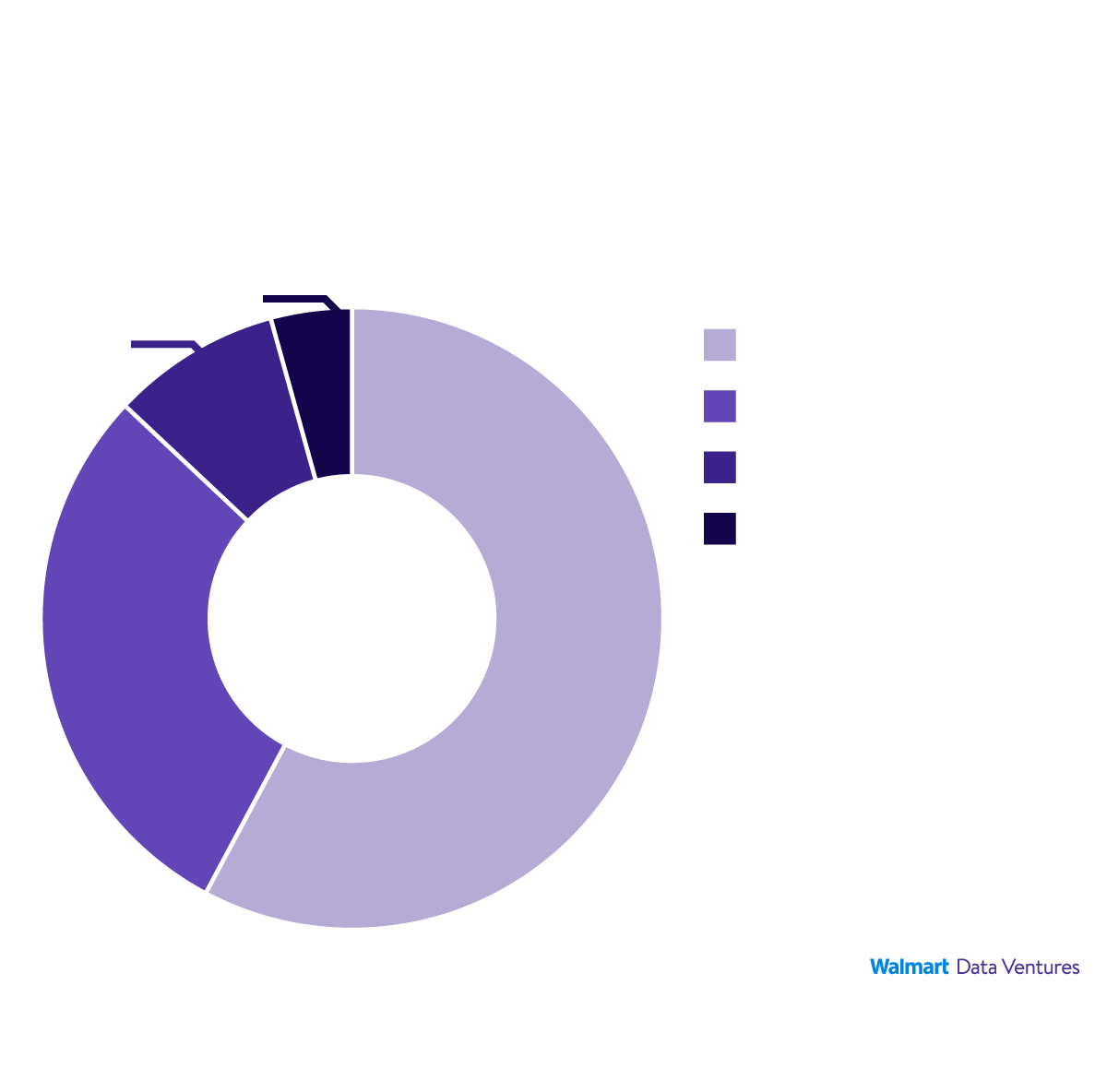

How far in advance Walmart customers

plan to begin holiday shopping

4%

9%

4 weeks (or more) in advance

3-4 weeks in advance

1-2 weeks in advance

1-6 days in advance

58%

29%

Source: Walmart First-Party Data, September 2024, "Holiday Survey"

Walmart Customer Spark Community, provided by Scintilla

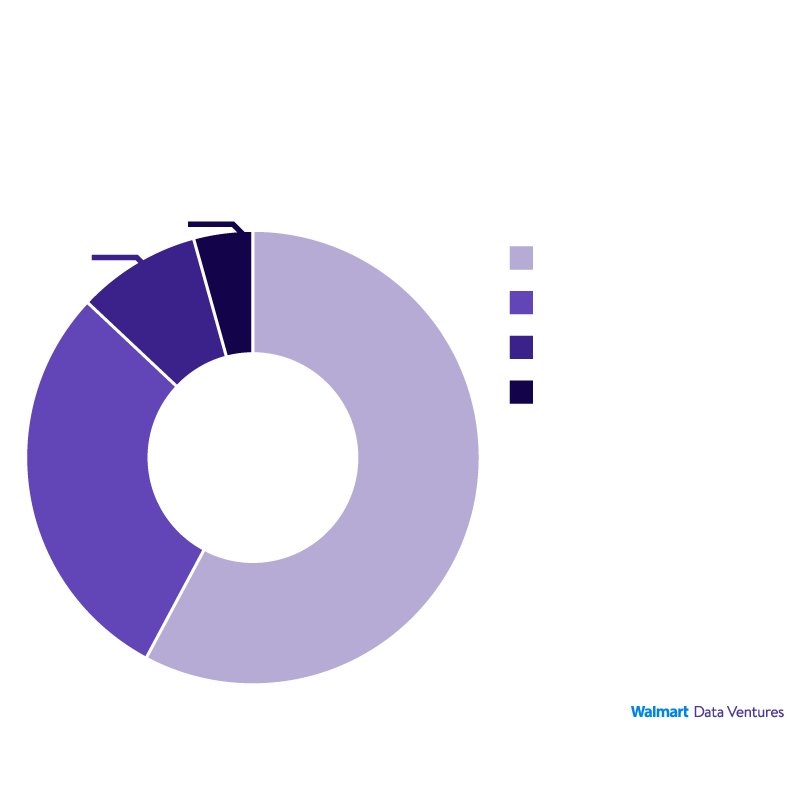

How far in advance Walmart customers

plan to begin holiday shopping

4%

9%

4 weeks (or more) in advance

3-4 weeks in advance

1-2 weeks in advance

1-6 days in advance

58%

29%

Source: Walmart First-Party Data, September 2024, "Holiday Survey"

Walmart Customer Spark Community, provided by Scintilla

Want to engage with the honor roll of early shoppers? 80% of surveyed Walmart+ members plan to take advantage of Early Access to shop Black Friday deals this holiday season.

Scintilla Pro Tip: Prep early for holiday demand. Use Scintilla’s Channel Performance Report Builder and API Feeds to forecast sales for up to 104 weeks. Ensure popular seasonal items are stocked and promotions are validated ahead of time. By analyzing potential out-of-stock or overstock issues, you can optimize inventory and meet early shoppers’ needs during key sales events like Black Friday and Cyber Monday.

Are you looking to craft a best-in-class holiday strategy? Hit the books with Scintilla’s first-party insights and connect with Walmart customers eager to fill their carts with holiday cheer.

References:

Walmart First-Party Data, September 2024, “Holiday Survey”, Walmart Customer Spark Community, provided by Scintilla.